$11.6B ETH Short Squeeze Looms

The Ethereum price is once again experiencing a whirlwind of new price plunges and pitfalls. The asset is currently sitting at $4120, up 2% in the last 24 hours, but is still up for a shakeup in the future with a spree of new liquidations waiting to gnaw at the new Ethereum ATH. Will ETH be able to resist such sharp pangs of volatility to aim for a new price high consistently? Let’s find out.

Also Read: Ethereum Price is Down 23% Since It’s Last ATH: When Will It Recover?

Massive Liquidations Waiting To Hit ETH

According to a recent update by the Whale Insider, nearly $11.6B in shorts are currently in line to liquidate as soon as the Ethereum price hits a new high target. This will once again push the price of ETH down, making it difficult for the asset to gain further momentum.

“JUST IN: Over $11.6 billion in $ETH short positions will be liquidated when the price reaches a new all-time high.”

While this move is poised to deliver a significant pitfall for the token to experience, ETH proponents are viewing this move as another possible shot for Ethereum to leverage and adapt.

“If $ETH moves right, shorts won’t just get wrecked; they’ll fund the rally.”

In the middle of this, leading cryptocurrency experts continue to issue bullish price projections for the Ethereum price to conquer. Per Titans of Crypto, Ethereum is targeting a new high of $6400, as its chart is displaying a bullish W structure, indicative of its new price path and trajectory.

“#Ethereum Highest Quarter in History? If #ETH closes above $3,700, this would mark the highest quarterly close ever. Only 2 days left until the Q3 candle closes.If confirmed, the W structure breakout points to a target around $6,400.”

Asset’s Technical Analysis

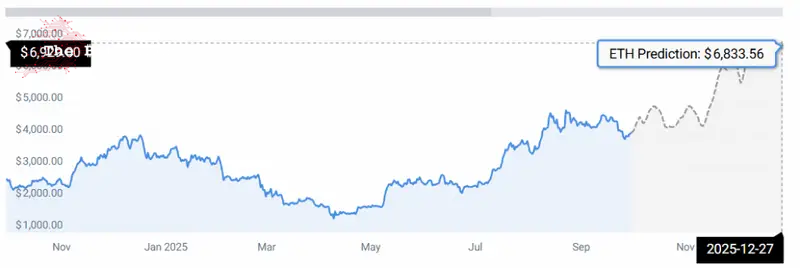

According to CoinCodex ETH data, the Ethereum price is currently eyeing a new high of $6894 by December 2025, mirroring the experts’ price projection above.

“According to our current Ethereum price prediction, the price of Ethereum may rise by 67.48% and reach $6,894.58 by December 28, 2025. Per our technical indicators, the current sentiment is neutral, while the Fear & Greed Index is showing 37 (fear). Ethereum recorded 14/30 (47%) green days with 4.31% price volatility over the last 30 days. Based on the Ethereum forecast, it’s now a good time to buy Ethereum.”

Also Read: Gemini Says XRP 5‑Year ROI Beats Bitcoin, Ethereum

Comments

Post a Comment