Bitcoin Price Prediction: Can BTC Break the $20,000 Resistance in 2023?

Bitcoin price prediction remains unchanged as BTC consolidates in a narrow range of $16,450 to $16,750. The two most valuable cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), are currently trading at around $16,500 and $1,100, respectively, after failing to break out of their consolidation ranges.

The gloomy cryptocurrency market, which typically underpins riskier assets such as Bitcoin (BTC) and Ethereum, could be to blame for the currency's downward rally.

Cryptocurrency prices, including Bitcoin (BTC) and Ethereum (ETH), have stabilized in 2022, with the global market cap falling below $800 billion for the first time in months. This is due to a number of factors, including geopolitical volatility, rising COVID concerns, the Fed's tightening of policy, and the Terra/Luna ecosystem implosion.

Ethereum, the second largest cryptocurrency, is trading at around $1,200, but Bitcoin remains well above the $16,500 mark. If news coverage remains positive, crypto assets such as Bitcoin are expected to retain their value until at least 2023.

As previously stated, the slow price movement of the major cryptocurrencies may be the cause of ongoing financial turbulence and Covid fear, which are discouraging investors from investing in riskier assets. The majority of bitcoin users have liquidated or intend to liquidate their cryptocurrency wallets due to the deterioration in economic conditions.

Emiliano Grodzki, a Co-founder & CEO of the Bitcoin Mining Operation Bitfarms, Resigns

Emiliano Grodzki, co-founder and CEO of the Canadian Bitcoin mining company Bitfarms, resigned on December 29, according to a press release. It is worth noting that Emiliano Grodzki and Nicolas Bonta founded the mining company in 2017.

Although Emiliano Grodzki will remain a director, Bonta will take over as chairman of the board. As a result of Grodzki's departure, President and Chief Operating Officer Geoffrey Morphy has been promoted to CEO.

As we all know, the bear market has had a negative impact on Bitcoin miners, as their daily revenue has fallen to all-time lows. Bitfarms has suffered back-to-back losses in the last two quarters, despite the current market conditions.

In Q3, 2022, the corporation lost $85 million, compared to $142 million in Q2. The company has also been attempting to reduce its debt; in November of last year, it paid off $27 million. Since January, the value of Bitfarm's shares (BITF) has fallen by more than 90%.

As a result, this news was regarded as one of the major factors that had a negative impact on the price of BTC.

Fed Policy Tightening & Major Exchanges Collapse

The Fed's tightening of policy, as well as the implosion of the Terra/Luna ecosystem, hedge funds Three Arrows Capital, and the FTX exchange, all, weighed on digital assets. This year, digital assets suffered significant losses as the Federal Reserve and other major central banks around the world raised interest rates to combat unprecedented inflation.

Several factors, including the Federal Reserve's tightening of policy, as well as the collapses of the Terra/Luna ecosystem, hedge funds Three Arrows Capital, and exchange FTX, all played a significant role in undermining the two most valuable cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH).

Because of the high-profile collapses of Terra/Luna and FTX this year, which sent shockwaves through the sector and erased more than $2 trillion from the total crypto market cap all-time high from November 2021, this year has been referred to as the winter season for cryptocurrencies.

Bitcoin Price

The current bitcoin price is $16,564, with $15 billion in trading volume in the last 24 hours. Bitcoin is gaining solid support on the 4-hour time frame at $16,460, which is being extended by an outward trend line visible in the chart below.

A positive breakout of the $16,720 level might lead to Bitcoin price reaching the next resistance level of $16,990. Because the RSI and MCD are negative, a bearish breakout of the $16,460 level might expose Bitcoin to immediate support levels of $16,200 or $16,000.

A further negative breakdown of $16,000 today might expose BTC to the $15,500 level.

Higher-Profit Cryptocurrencies

Given the market's aversion to risk, traders are looking for alternatives with better short-term prospects. Early investors can participate in the market's largest pre-sales.

FightOut (FGHT)

The FightOut (FGHT) platform functions similarly to a personal trainer, with the exception that the FGHT token is proactively awarded for workout time. All activities are recorded and can be used to improve one's metaverse avatar's statistics.

Earning FGHT tokens provides users with an additional motivation to maintain a healthy lifestyle and exercise while reaping the benefits of blockchain technology. FightOut has thrived and attracted investors despite the general lack of liquidity in the bitcoin market. It has already raised more than $2.5 million through its token sale, which began last week.

The current selling price of 60.06 FGHT for $1 (FGHT may be purchased with ETH or USDT) will rise as the sale goes on.

Visit FightOut Now

Dash 2 Trade (D2T)

Dash 2 Trade will be an Ethereum-based platform that will provide real-time analytics and social trading data when it starts in early 2023. Trading signals, on-chain analytics, strategy-building tools, and newsfeeds will be among the first Features, assisting both novice and experienced traders in keeping up with the volatile bitcoin market.

Dash 2 Trade, one of the key ICOs of 2022, has revealed its dashboard beta with only 6 days until the presale finishes. D2T has already raised over $11.6 million in venture capital. D2T is the system's access coin, and it is now worth $0.0533 in the presale after selling to investors for $0.0476 earlier.

Visit Dash 2 Trade Now

C+Charge (CCHG)

C+Charge (CCHG) is a peer-to-peer payment system for electric vehicle (EV) charging stations based on the Binance Chain. It plans to expand access to carbon credits by rewarding customers who charge their electric vehicles at its terminals, which are set to debut in the second quarter of next year.

Already, the platform has agreed to add 20% of Turkey's EV chargers to its network, demonstrating its potential to scale quickly. 1 CCHG costs $0.013, and can be bought with BNB or USDT. So far, the project has raised over $47,800 in presale.

Visit C+Charge Now

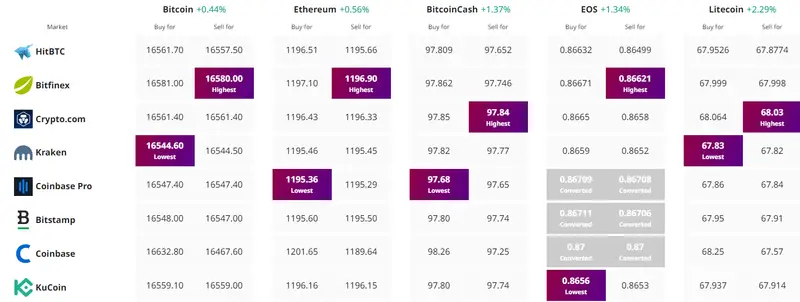

Find The Best Price to Buy/Sell Cryptocurrency

Comments

Post a Comment