Is Michael Saylor the Do Kwon of this bitcoin cycle?

Michael Saylor’s rise to prominence among bitcoin (BTC) investors is drawing considerable criticism. One particularly disparaging analogy claims that his BTC-buying tactics at MicroStrategy are similar to Do Kwon’s own from 2022.

To understand this apparent parallel, it’s worth revisiting Kwon’s story and the months before his criminal prosecution.

To be clear, no government agency has accused Saylor of any crime and there’s no indication that he — unlike Kwon — is misappropriating bitcoin. If a critic makes this comparison in good faith, the focus is squarely on Kwon’s goals of acquiring and financializing BTC via an acquisition strategy to rival Satoshi Nakamoto’s holdings.

Similar to MicroStrategy’s goal of endless BTC acquisition, Kwon’s Luna Foundation Guard aimed to acquire more than one million coins.

In 2022, however, the plan failed spectacularly.

Do Kwon wanted to buy one million bitcoin

When Kwon and his stablecoin giant Terra (UST) were at their zenith in April 2022, BTC was pumping. UST was worth over $40 billion plus another $17 billion in his governance token LUNA and since UST’s launch in 2019, BTC had rallied 400%.

In 2022, Kwon claimed that he would lead the Luna Foundation Guard to acquire 1 million BTC to support a stable peg for UST — a stash to rival Bitcoin’s creator Satoshi Nakamoto.

Unlike UST, which was a $1 stablecoin, LUNA fluctuated in price and was integral to Kwon’s empire. It not only provided collateral for UST redemptions but also offered voting privileges within Kwon’s ostensibly decentralized ecosystem.

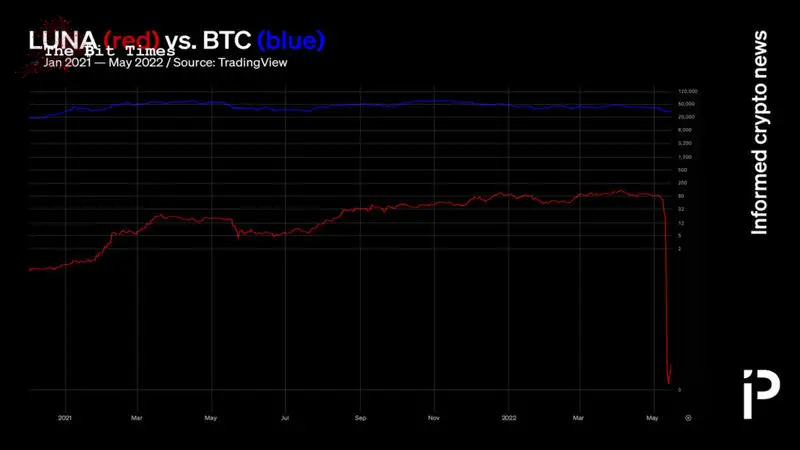

When Kwon launched LUNA in 2019, the coin was worth less than $10 and BTC was worth less than $10,000. Nearing his final months of prominence, by December 2021, LUNA was worth $100 and BTC had rallied to $50,000.

Although the price of BTC goes up for many reasons, its correlation with Kwon’s ascension was extraordinary.

Read more: CHART: Do Kwon’s extradition has seen a total of 23 developments

In November 2021, traders grew increasingly bullish on Kwon’s empire and his ability to buy BTC supply off the market. That month, BTC hit what was then an all-time high of $69,000.

Near the end of Kwon’s empire, his Luna Foundation Guard proclaimed that it had raised $1 billion to buy BTC and intended to raise another $10 billion to buy more.

Ultimately, that $10 billion raise never happened. Three months later, Terra and LUNA crashed 99.9% and never recovered, leaving Kwon to face criminal charges abroad and numerous US civil lawsuits related to his alleged fraud.

Michael Saylor also wants to buy one million bitcoin

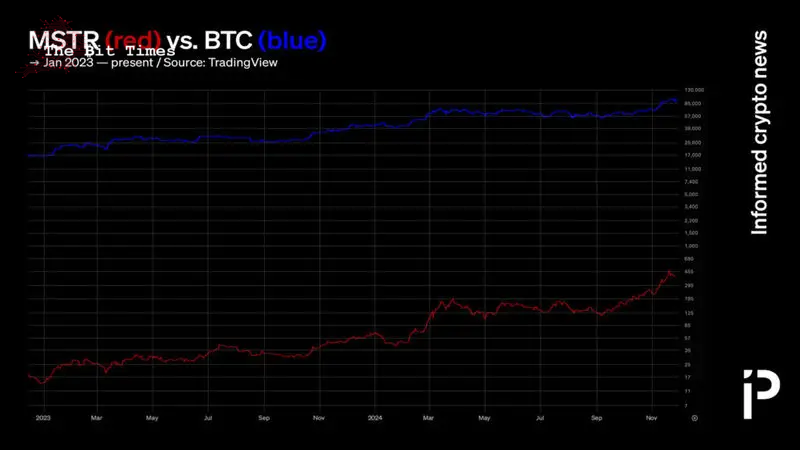

That history — a charismatic leader of a BTC-acquiring entity leading to market exuberance — is inevitably drawing comparisons to MicroStrategy and its billionaire CEO.

Both men forecasted a supposedly transformative business model that would unlock a new suite of BTC-backed products and services.

In Kwon’s case, he claimed that assets like BTC would allow his Luna Foundation Guard to defend the $1 peg of his stablecoin and associated suite of decentralized finance offerings.

Saylor, on the other hand, is advertising future offerings like bonds, options, decentralized identity, or traditional banking services like loans, all backed by his trove of BTC.

“The endgame is to be the leading Bitcoin bank, or merchant bank, or you could call it a Bitcoin finance company… MicroStrategy is the only bitcoin investment bank and will, in the future, be the most well-capitalized bitcoin investment bank ever.”

-Michael Saylor

Fans of Saylor think that he can buy $100 billion worth of BTC, issue BTC-backed securities, or disrupt the world’s $100 trillion bond market.

Indeed, one MicroStrategy follower posted an exaggerated projection that MicroStrategy could become the first $50 trillion company. Others seemed convinced that the firm’s shares could trade to 10X its BTC holdings.

As of publication time, MicroStrategy owns over $35 billion worth of BTC and is trading at a 2.2 multiple on those holdings. Its common stock has rallied 459% year-to-date.

Read more: MicroStrategy bulls think Michael Saylor can pump it to 10X its BTC

Other comparisons

While Saylor can be seen reveling in his ongoing success, Kwon’s historical posts linger hauntingly. His last posts are vain defenses of the Luna Guard Foundation and his work to restore UST’s value, along with talk of half-baked attempts to relaunch Terra as Terra2.

Although there are very few meaningful comparisons between Kwon and Saylor, both men capitalized on their bullish forecasts for BTC. To be sure, they issued extraordinary promises to cheering investors on social media who filled their bags with digital coins.

Although MicroStrategy is nothing like the Luna Foundation Guard, critics think the two entities’ goals of acquiring a million BTC are equally silly. As of publication time, MicroStrategy owns 386,700, and Luna Foundation Guard owns zero.

Got a tip? Send us an email or ProtonMail. For more informed news, follow us on X, Instagram, Bluesky, and Google News, or subscribe to our YouTube channel.

Comments

Post a Comment